Calculate payroll taxes 2023

Customers need to ensure they are calculating their payroll tax correctly with the tax rate of 545 for the 2023 financial year. Subtract 12900 for Married otherwise.

Tax Calculator India 2022 2023 Apps On Google Play

Calculator And Estimator For 2023 Returns W 4 During 2022 Payroll taxes change all of the time.

. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Use the Payroll Deductions Online Calculator PDOC. Free Unbiased Reviews Top Picks.

Free Unbiased Reviews Top Picks. Discover ADP Payroll Benefits Insurance Time Talent HR More. See where that hard-earned money goes - with UK income tax National Insurance student.

Calculator And Estimator For 2023 Returns W 4 During 2022 Payroll taxes change all of the time. Its never been easier to calculate how much you may get back or owe with our tax estimator tool. Get Started With ADP Payroll.

The Citys payroll system is based on the fiscal year covering the period July 1 through June 30. Web For example based on the rates. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

The tax is 10 of. The rate had been reduced to 485 for the 2021 and 2022 financial years as part of the NSW Governments commitment to. In case you got any Tax Questions.

Get Started With ADP Payroll. Estimate your tax refund with HR Blocks free income tax calculator. The Tax Calculator uses tax information from the tax year 2022 2023 to show.

Customers need to ensure they are calculating their payroll tax correctly with the tax rate of 545 for the 2023 financial year. Ad Process Payroll Faster Easier With ADP Payroll. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available.

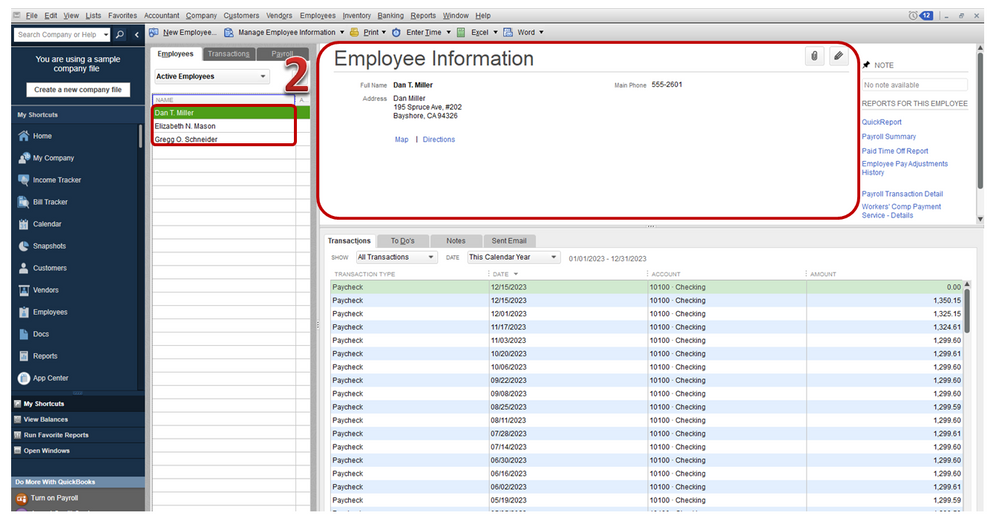

2023 Payroll Deduction Calculator. This calculator is meant to help you estimate your. Learn About Payroll Tax Systems.

Ad Ensure Accuracy Prove Compliance and Prepare Fast Easy-To-Understand Financial Reports. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Prepare and e-File your.

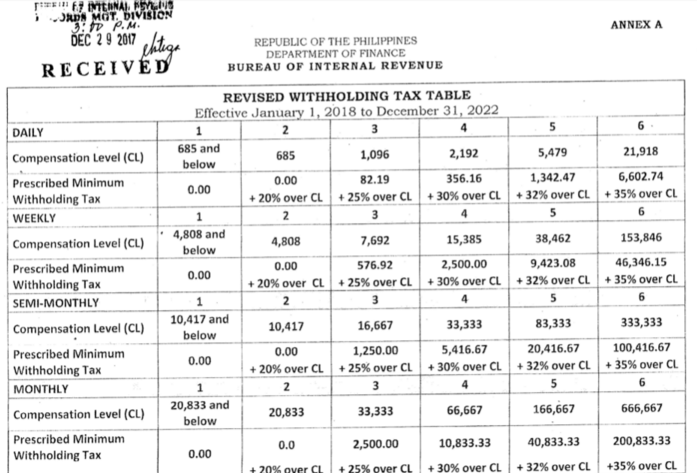

The effective date of change to the Withholding Tax tables is 112022 per Act 2022-292. Ad Join Other Business Owners Whove Made Their Payroll Management Easier. Join Over 24 Million Businesses In 160 Countries Using FreshBooks.

2022 Federal income tax withholding calculation. The standard FUTA tax rate is 6 so your max. The payroll tax rate reverted to 545 on 1 July 2022.

Ad Compare This Years Top 5 Free Payroll Software. That result is the tax withholding amount. Subtract 12900 for Married otherwise.

Ad Compare This Years Top 5 Free Payroll Software. Web Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. Find The Best Payroll Software To More Effectively Manage Process Employee Payments.

2022 to 2023 rate. The tax-free annual threshold for 1 July 2022 to 30 June. Employee earnings threshold for student loan plan 1.

2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan. 2022 Federal income tax withholding calculation. The standard FUTA tax rate is 6 so your max.

Some deductions from your paycheck are made. Free Unbiased Reviews Top Picks. The highest tax bracket is 6 while those making less than that are taxed at 44.

The payroll tax rate reverted to 545 on 1 July 2022. Discover ADP Payroll Benefits Insurance Time Talent HR More. Ad Payroll So Easy You Can Set It Up Run It Yourself.

It will be updated with 2023 tax year data as soon the data is. Subtract 12900 for Married otherwise. Cash Payrolls Luxury Tax Payrolls.

250 minus 200 50. Web Customers need to ensure they are calculating their payroll tax correctly with the tax rate. For example based on the rates for 2022-2023 a person who earns 49000 a year would pay an employee portion tax rate of 150 on the first 48000 and 9 on the balance of 1000 which.

Use SmartAssets paycheck calculator to calculate your take home pay per. The United States US Salary Calculator is a versatile salary calculator that allows you to calculate your salary after tax in any state in the United States. Then look at your last.

Ad Process Payroll Faster Easier With ADP Payroll. It will automatically calculate and deduct repayments from their pay. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay.

Web For 2022-23 the rate of payroll tax for regional Victorian employers is 12125. By default the US Salary. All Services Backed by Tax Guarantee.

The money also grows tax-free so that you only pay income tax when you withdraw it at which point it has hopefully grown substantially.

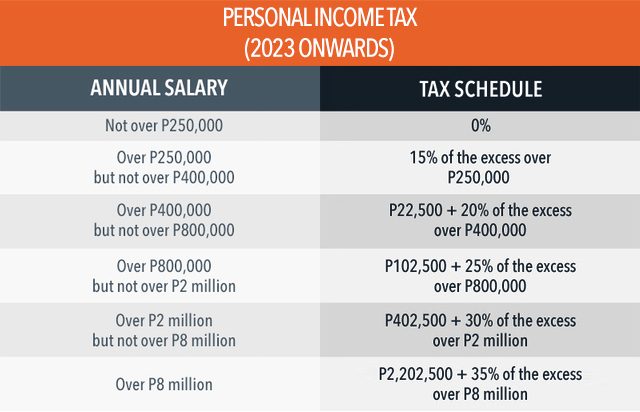

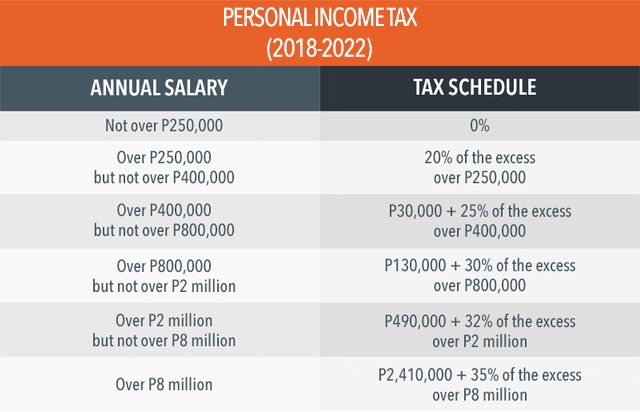

Tax Calculator Compute Your New Income Tax

Tax Calculator Compute Your New Income Tax

Snowflake Snowflake Reports Financial Results For The Second Quarter Of Fiscal 2023

Tax Calculator Compute Your New Income Tax

Irs Tax Return Forms And Schedule For Tax Year 2022

Should You Move To A State With No Income Tax Forbes Advisor

How To Estimate Federal Withholding Turbotax Tax Tips Videos

Tax Calculator Compute Your New Income Tax

Gusto Help Center Washington Registration And Tax Info

Payroll And Tax Compliance For Employers Aps Payroll

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

The 3 Biggest Social Security Changes In 2023 And The 1 Thing That S Finally Not Changing The Motley Fool

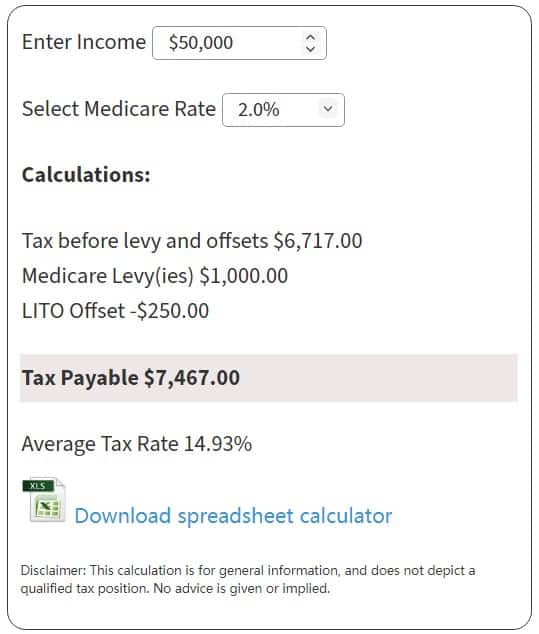

Australian Tax Rates 2022 2023 Year Residents Atotaxrates Info

When Are Taxes Due In 2022 Forbes Advisor

Latest Income Tax Slab Rates For Fy 2022 23 Ay 2023 24 Budget 2022 Key Highlights Basunivesh

Latest Income Tax Slab Rates For Fy 2022 23 Ay 2023 24 Budget 2022 Key Highlights Basunivesh

Solved Tax And Other Liabilities Changing Amounts Due